Church Finances

One of the difficulties in responding to criticisms against the Church is that even after they are debunked, some time goes by and they are resurrected again. Like Lazarus of old, the claims just won’t die. Such is the case with criticisms about the Church Finances.

For more on this, see A Prophecy Fulfilled: Church finances are a blessing from God and The $100 Billion ‘Mormon Church’ story: A Contextual Analysis

What do we know about Church Finances?

- The Church is very conservative in its financial practices. It never spends more than it takes in, and it always puts a portion of the income aside into savings.

- Unlike other organizations, no one receives bonuses for bringing in more money. No one has their income tied to Church wealth.

- The Church funds have many watchdogs. Not only do they have the managers at Ensign Peak Advisors, but they report to the Presiding Bishopric. The Presiding Bishopric in turn reports to the Quorum of the Twelve Apostles. In addition, they have auditors – independent tax advisors that come in and audit their funds annually.

- They do everything they can to follow the law. Dealing with the laws of over 150 countries, that can be difficult.

Why does the Church need so much money?

There are different ways of looking at this. Let’s first look at the Church as an educational institution.

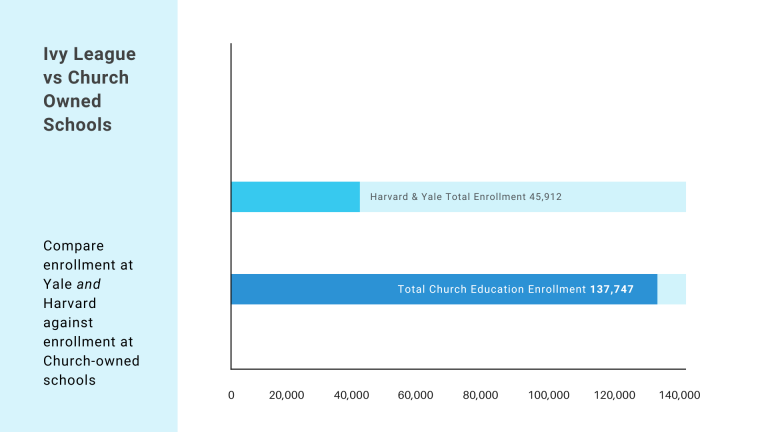

Not counting their Seminary and Institute Programs, the Church operates 5 different educational institutions. The total students involved are approximately 138,000. One of those institutions, BYU Pathway Worldwide, operates in 150 countries.

- BYU enrollment is approximately 36,461 students

- BYUI enrollment is approximately 34,390

- BYU Hawaii enrollment is approximately 2,893

- Ensign College enrollment is approximately 2665

- Pathways enrollment is approximately 61,338

Total Church Educational enrollment is approximately 137,747

Let’s compare that to Harvard and Yale.

- Harvard enrollment is approximately 31,345

- Yale enrollment is approximately 14,567

Total enrollment for Harvard and Yale is approximately 45,912.

What do Harvard and Yale have to do with Church finances?

Well, it just so happens that both Harvard and Yale each have an endowment fund – much like the fund that is operated by the Church.

The combined endowments of Harvard and Yale are $95 billion ($53.2 + $41.4). The Church is rumored to have a $100 Billion investment, and if you were just looking at the educational side, it is less per student than Harvard and Yale currently have.

In addition, the Church operates Churches, temples, Welfare programs, participates in humanitarian aid, Donates to the Red Cross, the Red Crescent, and other Charities (under humanitarian aid), gives out food and funds under the fast offering program, provides service missionaries to work in communities, sponsors the Just Serve to help communities, funds family history work, funds history research and publishing, and more. They operate in 188 languages across the globe. So, if Harvard and Yale feel that their endowment is appropriate for the number of students they serve, it is easy to argue that the Church endowment might still be too small.

For more on this, see Why would the Church put tithing into investment portfolios?

Looking at it from a per-capita basis

If you look at the finances from a membership position, and divide the alleged $100 billion by the 17 million members, you would find it to be a little less than $6000 per member. So, it sounds like a large sum, but per capita it is not.

Looking at it from a corporate basis

How does the Church compare with other large companies that operate in multiple countries?

- Apple total current assets for 2022 were $135.405B

- Microsoft total current assets for 2022 were $169.684B

So, the Church does compare with other large companies in that it has money. But, it certainly is not the largest company.

For more on this, see Does the Church of Jesus Christ of Latter-day Saints own stock in businesses that are not consistent with the Church’s standards?

But what about the whistleblower complaint? They alleged the Church did something wrong!

This claim came out in 2019. People who looked at it disagreed with the allegations. Forbes Magazine did an article on this in which they discussed the matter with Paul Streckfus of the EO Tax Journal. He said, “As far as bailing out the insurance company and the shopping mall, who is to say this was not a justified use of funds to try to save failing investments? In order for section 4958 on excess benefit transactions to come into play, I think the IRS would have to show some individuals benefiting personally from the bail out. Poor business judgment would not be sufficient.”

For more on this, see Post-Mortem Analysis on this Year’s Exposé Stunt, Some Thoughts About Ensign Peak Advisers and the Church and IRS Whistleblowers Revisited

What about the SEC Violation?

The SEC and the Ensign Peak tax people had a disagreement with how things should be reported. Everything was reported. No money was hidden from the IRS or from the SEC. It had to do with which forms were used to report the funds. The SEC asked the Ensign Peak to do it differently, and Ensign Peak complied. While it could be argued about whether they were right or wrong, there was no willful non-compliance, no embezzlement, no misappropriation of funds, and nobody enriching themselves.

For more on this, see Church financial reporting to the SEC – FAIR (fairlatterdaysaints.org)

Conclusion

Church finances have been used as a place to attack the Church for a long time. It was not that long ago that the Church was lacking in funds. Now, it is not. That is a good thing.

You may have heard about shell companies. Typically, when you hear the term you immediately jump to the conclusion that something illegal is going on. In modern dramas they are typically used with money laundering or drug trafficking. But, that isn’t their only purpose. If that was all they did, they would be illegal, but they are not. They are very legal, and are commonly used, But they can be misused, so they are closely monitored by the government.

What is a Shell Company?

A shell company, also known as a “shell” corporation or simply a shell, is a type of company that exists on paper but does not have significant operations or active business. It is often created for financial or legal purposes, rather than for conducting substantial commercial activities.

Shell companies typically lack employees, physical assets, or substantial operations. They may have a minimal presence, such as a registered office or a nominal number of employees to fulfill legal requirements. However, their primary function is to serve as a vehicle for certain financial activities or transactions.

Why Have a Shell Company?

Companies may use shell corporations for various reasons, some of which include:

Privacy and anonymity:

Shell corporations can provide a layer of privacy and anonymity for individuals or companies involved in certain transactions. By conducting business through a shell corporation, the true owners or beneficiaries can remain hidden from public view, making it difficult for others to trace their involvement.

Tax optimization:

Shell corporations can be established in jurisdictions with favorable tax laws or lower tax rates. Companies may use these entities to engage in tax planning strategies, such as profit shifting or tax avoidance, in order to minimize their overall tax burden.

Asset protection:

Shell corporations can be used to separate and protect valuable assets from potential legal claims or creditors. By placing assets under the ownership of a shell corporation, a company can shield them from potential risks or liabilities associated with the parent company.

Merger and acquisition activities:

Companies may create shell corporations as part of their merger and acquisition strategies. These entities can be used to facilitate the purchase or sale of assets or businesses while keeping the details confidential until the deal is finalized.

Investment and venture capital activities:

Shell corporations can be established to serve as investment vehicles or holding companies for various assets. This structure allows companies to segregate specific investments or projects, manage risk, and attract funding from different sources without directly involving the parent company.

The legality of a shell company depends on how it is used and the purpose for which it is established. They are not inherently illegal.

While shell companies are often associated with illicit activities, it’s important to note that companies use them for legitimate purposes. Both Google and Apple have made use of shell companies.

The legitimate uses primarily revolve around lawful business operations, asset protection, and privacy. Here are a few examples of companies that have utilized shell companies for legitimate reasons:

Holding companies:

Many multinational corporations create subsidiary shell companies as part of their organizational structure to hold assets, intellectual property rights, or to manage investments in different regions. This practice helps with risk management, tax planning, and legal compliance.Real estate transactions:

In real estate, shell companies may be used for privacy and anonymity during property acquisitions or investments. This allows individuals or businesses to maintain confidentiality in their real estate dealings. Sometimes if people learn the identity of the individuals or businesses doing the transaction, the price goes up. Using the shell company mitigates against that.Intellectual property management:

Companies often establish shell companies to hold and manage intellectual property assets, such as patents, trademarks, and copyrights. This can facilitate licensing agreements, protect intellectual property, and manage revenue streams.Joint ventures and partnerships:

In certain business collaborations, partners may establish a shell company to serve as an independent entity that holds the joint venture’s assets, contracts, and liabilities. This arrangement can help simplify operations, protect intellectual property, and allocate profits and losses.Startups and ventures in development:

During the early stages of a business or startup, a shell company structure might be employed to hold the intellectual property, secure funding, or facilitate investments. It allows for flexibility in future business development and expansion.

Why did the Church use Shell Companies?

It seems that The Church used shell companies with their investments for privacy purposes.

Why did they need privacy?

When doing financial transactions, it is often in your best interest to maintain some confidentiality. Otherwise, others try to profit from the transactions at your expense.

The Church wants to work on its mission. Unfortunately, there are many in the world who do not understand the mission of the Church. They wrongfully believe that the Church should take all of its money and feed the poor. The Church does feed the poor in great numbers, but it is not a foodbank. It is not even a Charity in the strictest sense of the word. It is a Church, and as such it needs funds to maintain its mission.

Too many people want to tell the Church how it should be doing things. It really isn’t any of their business. Nor do they know what the Church really needs.

Isn’t that just being secret?

I suppose you could call it that. But a better description would be being private. After all, do you post your checking or savings account balance on Twitter each month? Why not?

The Church of Jesus Christ of Latter-day Saints, often referred to as the LDS Church or the Mormon Church, operates a number of for-profit entities. These entities are separate from the Church’s nonprofit religious operations and are designed to support the Church’s mission and provide financial resources. Here are some notable for-profit entities associated with the LDS Church:

- Bonneville International Corporation: Bonneville is a media and broadcasting company that owns and operates several radio and television stations across the United States. It includes popular radio stations such as KSL NewsRadio and FM 100.3.

- Deseret Management Corporation (DMC): DMC is the for-profit holding company of the LDS Church. It oversees various subsidiaries and investments in diverse industries, including media, publishing, hospitality, agriculture, manufacturing, and real estate. Some of its notable subsidiaries include Deseret Book (a publisher and retailer of LDS Church-related materials) and Deseret News (a daily newspaper based in Salt Lake City).

- Beneficial Life Insurance Company: Beneficial Life is an insurance company that provides life insurance, annuities, and other financial products and services. It was founded by the LDS Church in 1905 and continues to operate under the Church’s ownership.

It’s important to note that these for-profit entities operate independently of the religious activities of the LDS Church and are subject to standard business practices and regulations. The Church uses the revenues generated by these entities to support its mission, including funding its nonprofit religious programs, humanitarian efforts, and maintaining its properties worldwide.

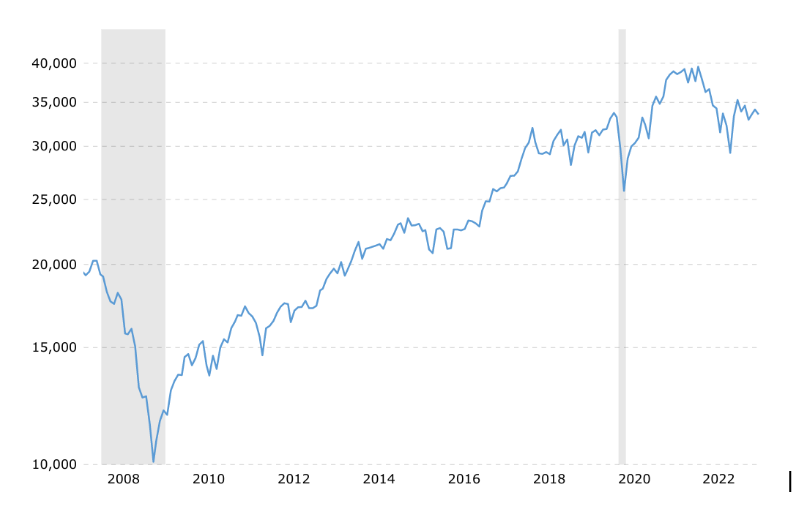

In early 2012, the economy wasn’t feeling all that good. The Great Recession had technically ended in 2009, but the recovery was weak. The Center for American Progress lamented “the slowest growth during the first eight quarters of an economic recovery since World War II.” Unemployment was still high–9.1% in August 2011–and job growth had slowed. The European sovereign debt crisis was keeping markets nervous. And DJIA, which had climbed to 20,000 in 2007 before plunging to 10,000 in 2009, was only back up to around 17,000.

I remember being a newlywed then, discussing with my husband how on earth to plan for the future when things seemed so uncertain. But we were at least a few years out from graduation, with a decent toehold in the job market. It must have seemed much more daunting to anyone just graduating college.

Against this backdrop, Elder M. Russell Ballard traveled to Rexburg to give the commencement address at BYU-Idaho.

Elder Ballard acknowledged the difficulty: “The conditions in the world are uncertain and dangerous, and the economies of the world are unstable and unpredictable.” But he continued: “Face the future with optimism.”

It’s hardly ground-breaking to encourage graduates to be brave and optimistic, but what absolutely floored me about this address is how specific he got. He was bold, and prophetic:

“I believe we are standing on the threshold of a new era of growth, prosperity, and abundance. Barring a calamity or unexpected international crisis, I think the next few years will bring a resurgence in the world economy as new discoveries are made in communication, medicine, energy, transportation, physics, computer technology, and other fields of endeavor…With these discoveries and advances will come new employment opportunities and prosperity for those who work hard and especially for those who strive to keep the commandments of God.”

Elder Ballard was so bold in predicting economic success that he included a lengthy warning to the graduates that their wealth would tempt them to pride and worldliness:

“I believe many of today’s young adults will be active participants in temporal blessings if they keep the commandments of the Lord. With prosperity will come a unique challenge—a test that will try many to their spiritual core…The trial of your faith in the next few years will likely not be that you lack the material things of this world. Rather it will be in choosing what to do with the temporal blessings you receive.”

He was also clear that the coming economic boom was not an accident, but a blessing from God to accomplish His specific purposes:

“In addition, many of these discoveries will be made to help bring to pass the purposes and work of God and to quicken, including through missionary work, the building of His kingdom on earth today…

“As the gospel is carried to billions of spiritually hungry souls, miracles will be performed by the hand of the Lord. Missionaries of many nationalities will serve the Lord throughout the earth. New chapels and many more temples will be built to bless the Saints, as has been prophesied regarding premillennial growth of the Church. You may ask, ‘Where will the financial resources come from to fund this growth?’ The resources will come from faithful members through their tithes and offerings. As we do our part, the Lord will bless us with prosperity…

“So for yet a season, possibly a short season, it will seem as though the windows of heaven will have truly opened so that ‘there shall not be room enough to receive it.’”

Again, that was on April 6, 2012.

I’m not much of a Facebooker anymore, but one big reason I’ve kept a perfunctory account is to follow the pages from various saints all over the world–the Ghana MTC, Area pages for various regions in Africa and Asia, a few scattered branches in Nepal and Pakistan and Sri Lanka and India and Uganda, etc. It’s a daily dose of straight-up miracles in my newsfeed. The constant stream of pictures of missionaries coming through the Ghana MTC is the first thing that came to mind when I read Elder Ballard’s promise that “missionaries of many nationalities will serve the Lord.” They’re preparing to serve in almost every country in Africa, and it’s so amazing and lovely to see their faces and think of the miracles they’re about to be the Lord’s hand in bringing about.

So many of those missions and branches didn’t exist in 2012.

In 2012, there were about 140 temples. We’re up to 315 now.

And shortly after April 2012, what did the stock market proceed to do?

Fwoom. Even with the huge Covid dip in 2020, the peak at nearly 40,000 is just amazing. As Elder Ballard predicted, the windows of heaven opened so that there was hardly room enough to receive it.

Fwoom. Even with the huge Covid dip in 2020, the peak at nearly 40,000 is just amazing. As Elder Ballard predicted, the windows of heaven opened so that there was hardly room enough to receive it.

A lot of news orgs have figured out “Mormon” = clickbait. Put Mormon in your headline and clicks increase. That’s part of the reason why the Church’s recent tussle with the SEC over how it reports its investment funds is getting so much attention. I don’t think the Church did anything morally wrong, and only biffed a couple of regulatory issues out of a good-faith desire to keep naive members from concluding “I’m going to copy the prophet’s investment strategy!” when it wouldn’t be good for them to do so.

Some people have reacted negatively to the mere fact that the Church has a lot of money. To them, I wanted to highlight this mostly-forgotten speech by Elder (now President) Ballard. The Church has a lot of money because it has missionaries to send, and temples to build, and students to educate. It has a worldwide kingdom to build.

The Church has a lot of money because the Lord blessed the Church with a lot of money.

This was foreseen in Elder Ballard’s prophetic address. Church leaders are using the money to carry out God’s will. The Good Ship Zion is not a luxury cruiser, and its crew are not amassing personal wealth. But it takes a lot of dough to carry out the most epic, most important mission in the history of seafaring, just before she pulls into her Millennial port. Literal prophets and seers are at the helm, literally prophesying.

Stay on board and grab an oar.

- Church Finances

- Why would the Church put tithing into investment portfolios?

- Why does the Church not provide public disclosure of its financial data?

- Did the Church hide its investments from the SEC?

- Is the Church guilty of tax evasion?

- Church financial reporting to the SEC (2023)

- Use of Church Funds

- Paid and unpaid Church leaders

- City Creek Center in SLC

- Response to claim: “while we know that a portion is used for the operational expenses of the Church, much of the donations make their way into business investments”

- Response to claim: “The lack of financial transparency by the LDS Church has put revenue estimates between $10-20 billion annually”

- Response to claim: “What are the Church’s for-profit business ventures?”

- Response to claim: “Even though City Creek clearly generates substantial income, the Church has reclassified it as a 501(C)3:Charitable Organization…to avoid paying taxes on property income it collects”

- Response to claim: “Every year billions of tithing dollars are funneled into these businesses for non-religious and non-humanitarian aid purposes”

- Response to claim: “the modern Church never passes an opportunity to remind us that all members, no matter how financially burdened, must pay them first. Yet…tithing funds are routed into multi-billion dollar investments”

- Response to claim: “Family Promise”…relief organizations help the needy and homeless in the backyard of the LDS church headquarters and should never have to turn away parents and children because their finances are ‘put to the test'”

- Response to claim: “The Church of Jesus Christ of Latter Day Saints was only 1 of 31 corporations that contributed to the Fourth Street Clinic’s private donations”

- Response to claim: “‘The Road Home partners with a variety of organizations to ensure families and individuals have the tools they need to get back on their feet.’ The Church of Jesus Christ of Latter Day Saints is not on that list”

- Response to claim: “Utah Food Bank”…The Church of Jesus Christ of Latter Day Saints is not listed as a member”

- Response to claim: “What if instead of investing billions of dollars a year into for-profit real estate, the Church built hospitals and homeless shelters, and actually tried to emulate the acts of kindness performed by Jesus for the sick and afflicted?”

- Response to claim: “We are not called to tithe, but to make an offering to sustain the church”

- Response to claim: “It appears that the LDS Church defined tithing differently in the early days of the LDS Church than they do now”

- Response to claim: “We are tithe payers…When can we see the financial information?”

- Response to claim: “Tithing as the Catholic priest said above should be a gift, but the LDS Church makes it an obligation”

- Response to claim: “The guilt placed upon Latter-day Saints can be considerable”

- Response to claim: “The church owns many businesses that generate profits…The church has very little expense in relation to its income. The tithing money it receives is all tax-free. The property is exempt from taxes”

- Response to claim: “Imagine if you had a corporation where the business model was to have your customers give you 10% of their income every year”

- Response to claim: “The Church hardly spends any of its money on humanitarian aid”

- Response to claim: “the church has far more than it needs”

- Response to claim: “why couldn’t the church sell its non-ecclesiastical assets and help the poor?”

- Response to claim: “Now they expect members (as if they didn’t spend enough time in church service) to clean their own buildings on their days off”

- Response to claim: “probably not really the way Jesus would have intended his church to be run”

- Response to claim: “where did the money come from to buy the businesses, stocks and other investments to generate those profits?”

- Response to claim: “Of all the things Jesus would tell Gordon Hinckley, He told the Prophet to buy a mall?”

- Response to claim: “It’s disgraceful to read some of the propaganda the Church puts out about tithing”

- Response to claim: “This absolute devotion of choosing to pay a religious entity that is worth some $100 Billion over feeding her children or paying the mortgage is nothing to be admired”

- Response to claim: “LDS leaders often hint at promises that tithe payers will receive increased income from paying tithes”

- Response to claim: “Many former Mormons continue to pay their tithing, but now do so to more traditional charities”

- Response to claim: “LDS tithes are hardly used for charity, but are used primarily to build the kingdom”