In Mosiah 7-19 we are told that Ammon and other Nephites from Zarahemla stumbled upon their brethren in Lehi-Nephi. We are told that the Lehi-Nephite decline started when King Noah raised income taxes from 10% to 20%, and culminated in their subjection to the Lamanites, who taxed them at a rate of 50%. Modern readers may wonder at this; why would the Nephites feel enslaved when many “free” nations nowadays have had much higher tax rates? (The USA had rates as high as 91%, and when Ronald Reagan won the US presidency in 1980, the top tax rate was 70%.) The “supply side” school of economic thought may provide an answer.

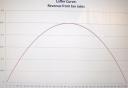

Contrary to popular belief, supply side economics does not mean that lower tax rates always mean higher revenues. What it does assert is that, above a certain optimal tax rate, revenues will cease to rise and begin to fall, as illustrated in this screen shot:

At lower tax rates, more people are willing to pay taxes, and, at higher rates, people tend to drop out of the tax-paying economy. Dr. Arthur Laffer postulated that there were two rates which yield zero revenue: Zero, for obvious reasons, and 100%, because nobody would work only to have nothing to show for it. Thus, raising taxes from zero or a low point would raise revenue, because the extra tax paid exceeds the people dropping out. However, after that optimal rate, higher rates yield lower revenues, because more people drop out than pay the extra tax.

Theoretically, of course, the Lamanites could have simply enslaved the Nephites outright, but that would have meant spending a lot more resources to spoil the Nephites. As it was, the Lamanites stationed guards around the settlement [See Mosiah 19:28] to minimize the drop-off from the Nephite economy. Evidently, the Lamanites reasoned that it was more cost-effective to station relatively few guards to prevent escape and to periodically despoil the Nephites than to have many more Lamanites trying each day to coerse work instead of escape attempts or revolts from sullen Nephite slaves.

Perhaps this is something for Brother Harry Reid and his colleagues in the US Congress to think about when they try to abolish Reaganomics. They seem to have forgotten the first two rules of economics: 1) There are only a finite amount of goods to satisfy an infinite amount of wants, and 2) everybody responds to incentives.

UPDATE: A few of the comments made it necessary for me to clarify:

1. If there were any pot shot at all it was against Congress as an institution. I only singled out Senator Reid because, as the senior legislative official in the Congress’ upper house, he is the Church member in the best position to quash such a planned repudiation of supply-side economics. True, there are at least three GOP Senators, but, as all are in the minority party and none of them is a ranking minority member of any relevant committee, they are all WAY down on the seniority scale, and are in no position to stop much of anything–even if they wanted to.

2. While major tax cuts were put into place under GOP presidents, and both Democratic candidates are campaigning to abolish those tax cuts, taxes are not necessarily a partisan issue. Senator Hillary Clinton’s [D-NY] husband, then-Governor Bill Clinton [D-AR], campaigned on a “middle-class tax cut” in 1992 for example. Moreover, in 1992, Arthur Laffer endorsed Clinton for President (and reiterated his support later!), while Senators John McCain [R-AZ] and Gordon Smith [R-OR] (one of the aforementioned LDS GOP Senators) both voted against at least one of the GOP-sponsored tax cuts.

3. Last Lemming is right that the 70% and 91% top marginal rates were different from the Lamanite 50% rate–the old US policy was both better and worse than the Lamanite rate. Better, because most Americans paid considerably less than the Lamanite rate, let alone the top US rates. However, it is also worse than the Lamanite rate, because increasing marginal tax rates act as an ever-growing disincentive to capital formation and wealth creation.

4. The Noachian policies have had their share of legitimate programmes (See Mosiah 11:10, 13), and the US spending its share of pork. And that pork knows no political boundaries. The Democrats’ “Midnight Basketball” and the GOP “Bridge to Nowhere” come to mind as examples.

5. I have elsewhere denounced war as a means of economic progress, but that is an entirely separate issue from using punishing tax rates to raise revenue. War isn’t a strictly partisan issue though; President Bush sent us to war in Afghanistan and Iraq, but his Democratic predecessor sent us to war in Kosovo and changed the mission in Somalia from one of supply to one of combat. Furthermore, his wife, Senator Hillary Clinton voted for war in both Afghanistan and Iraq, and Senator Barak Obama [D-IL] announced his intent to invade Pakistan, while Representative Ron Paul [R-TX] voted “Nay” to war both times the subject came up over the last seven years.

6. It is true that the Lamanite rate was meant as punishment while the high US and other welfare states’ tax rates were meant to raise revenue to pay for programmes designed to help people. (What I think of some of those programmes is another subject, to be treated elsewhere.) However, this leads nicely into my point: If the Lamanite punishing rates are set up to maximise revenue, then higher tax rates are, in effect, (unintended?) punishment for punishment’s sake–without the redeeming factor of raising revenue that pays for any worthy programmes. Given some politicians’ rhetoric (on both sides of the political aisle; notably Governor Mike Huckabee [R-AR] and Representative Dennis Kucinich [D-OH]), I’m not sure how unintended that punishment is.

7. It is true, Connor, that no economic policy exists in a vacuum, and not all other things are equal. For example, the tax rate increase of 1993 was more than offset by the tariff (i.e., taxes on imports) cuts of NAFTA and GATT/WTO, and the Noachian public works partially offset his doubling the tax rates. (The “Keynesian Multiplier” doesn’t completely cancel out the “Broken Window Fallacy.”)

While that graph is interesting from a revenue standpoint, I think it’d be even more interesting to graph other elements against the tax scale, such as GDP, politician approval ratings, private charitable contribution levels, individual saving rates, etc.

The 91 and 70 percent tax rates are not comparable to the 50 percent tax rates imposed by the Lamanites. The 50 percent seems to have been a flat rate without any exemptions–half of their labor went to the benefit of their enemies. The high marginal rates in the U.S. didn’t kick in until very high income levels. In the post-war era, federal taxes have hovered around 20 percent of GDP.

Furthermore, that 20 percent is not going to the benefit of our enemies. It is going to provide services that are politically popular, the biggest being national defense, Social Security, and Medicare. You may not be a fan of everything the government does, but Americans, not Russians, Iranians, or Venezuelans, are the ones setting the tax rates and deciding how to spend the revenues. The situation is just not comparable to that described in the Book of Mormon.

Incidentally, when I come to an apologetic website, I don’t expect to see permabloggers taking gratuitous pot shots at faithful members of the church. Or has this become the Foundation for Apologetic Information and Republicanism?

I agree with Last Lemming. The Lamanites weren’t taxing; they were demanding tribute.

When you read the anti-war sections of the Book of Mormon are you going to take pot shots at the Republicans?

This isn’t a dig on just Democrats; both parties are guilty. See my update for clarification.

The update doesn’t really refute a number of the comments, but the biggest problem seems to be a misreading of the Book of Mormon text, in that you’re applying modern meanings to words that haven’t always meant the same thing. That is, just because the Book of Mormon called something a tax doesn’t mean that it was a tax in the modern sense (remember that early nineteenth-century America didn’t really have income taxes as we have them now), and given that fact you can’t really move from the scriptural text to a critique of current tax policy, nor can you use the text in support of supply-side policies.

(Well, and the Laffer curve doesn’t actually work. But you probably already knew that.)

Hello David B.!

I note that you are an English professor at UCF. I live about 50 miles away, and do most of my econ teaching in Tampa.

Of course taxes in Book of Mormon times aren’t the same as taxes in modern times! If my main point was a specific critique of a particular tax, then your issue might be justified.

However, my point is only tangential to modern tax policy (which was why I didn’t say much about it!), and the principle is still the same, whether we deal with Book of Mormon, modern welfare states, or any other tax policies: the higher the tax, the more people try to avoid or evade those taxes. While MOST people would probably pay increased taxes, at some point, enough people would stop paying them (or at least pay not as much) to make tax increases not cost-effective.

The Lamanites knew this, even if most modern people do not. That was why they only took 50% of the Nephite wealth instead of 100%, while we elect people who are promising increased taxes along with increased government services. As it was, the Lamanites had to post guards to prevent too much of a drain of the economy.

A modern parallel would be the UK’s “Brain Drain” from the 1950’s to the 1970’s. The British, too, found that high, progressive tax rates demotivate the most productive.

I’m not sure what you mean by “the Laffer curve doesn’t actually work.” If you mean that the Laffer Curve is an oversimplified approximation of reality, you may be right. The exact shape and optimal tax rate described by the Laffer Curve varies with price elasticity of government. That optimal tax rate would be higher the less elastic government services are. That elasticity, of course, varies; during war time, for example, the elasticity would often be less than that of peacetime.

However, taking that into account would have over-complicated the picture. Estimates of price elasticity of government range from a low of 0.3 to a high of 3.0. Taking the “middle ground” of unit elasticity between extremes seemed reasonable; I could more easily illustrate the concept without resorting to calculus and more complicated mathematics. I can do the maths, but, as most people cannot, why add confusion?

On the other hand, if you mean that the Laffer Curve and supply-side economics are totally bogus, we are still left with the question at the title of this blog entry: “Why not all?”

If supply-side theory is wrong and people will pay whatever the powers that be demand, the Lamanites could have easily enslaved them all and taken every whit of the Nephites’ wealth–and avoided the extra costs of guarding Lehi-Nephi.

That would have the logical thing to do–yet the Lamanites did not do it. Why? I could find nothing else to explain this but supply-side theory–that is, for those of us who accept the historic nature of the Book of Mormon.

😉

Strawman.

I said that the Book of Mormon can’t be used in support of supply-side economics, not that supply-side economics doesn’t work (though, admittedly, i am a skeptic about that particular economic theory).

Why did the Lamanites take 50% and not 100%? The simplest solution is not because they believed in supply-side economics, but because they could think ahead two or three moves and didn’t want to kill the geese that were laying the golden eggs—if the People of Limhi had had 100% of everything taken from them, they wouldn’t have been able to eat and would have starved to death, resulting in a net loss to the Lamanites of 100% of the tribute (not tax!) they levied.

And i daresay that the Lamanites would have probably had to post guards even if the tribute levy had been 0%—human history, and particularly the history of the Israelite people, is filled with people hating being under subjugation to even a benevolent power.

But David, not killing “the geese that were laying the golden eggs” is what supply-side economics is all about!

I know that it was “tribute (not tax!),” but the principle is still the same: Getting the most revenue. The US government’s euphamism, “voluntary compliance” simply hides the fact that both taxes and tributes are obtained at the point of a gun. As the economist Walter Williams put it: Guess what would happen if we didn’t pay our taxes….

😉

You are quite right that people resent subjugation, but I would dispute that guards would have been necessary. Being left alone and paying no tribute is hardly subjugation!

😉

Mosiah 19:15 tells us that, except for delivering up King Noah, the tribute was the only term of the subjugation. I saw no mention of the normal trappings of subjugation, like the Nephites being drafted into the Lamanite army, or being forced to work in the Lamanite fields at little or no pay. I’m human, though; I may have missed it.

😉

In 1848, the USA conquered what became the States of California, Nevada, Utah, Arizona, Colorado, and New Mexico. As the Lamanites did with the Nephites, the USA generally left the erstwhile Mexicans alone, but unlike the Lamanites, the USA inflicted zero tribute. The USA found it unnecessary to post guards to prevent them from leaving–and not paying tribute. You may recall that, once the Nephites did leave town, the tribute payments stopped.

Hence, if the tribute were zero, there would be no need for guards, because the Lamanites otherwise left them alone.

Do I make sense?

Oh, one other thing: I’m not using the Book of Mormon to support supply-side economics; I’m using supply-side economics to explain the Book of Mormon.

I think the real question is; whose money is it?

When I earn a dollar does it belong to me, or am I just the chattel of the government and it is really their dollar, and they will decide how much money I can keep (use)?

And when I have a dollar in my hand is that paper dollar a sign of a credit or a debit? And when you can understand that, the door is open.

-David

For the record, I do feel enslaved with the tax rates that we live under. Perhaps I have Nephite blood I haven’t discovered yet;}

Hi David Littlefield!

That is a GREAT question about who owns the dollar! Let me try to answer it. 😉

People’s opinions about it differ; Pennsylvania, for example, has as part of its Constitution to the effect that ALL resources were owned by ALL the people–the government, of course, being the trustee. As I’ve observed, whenever the government decides that they need more money for various projects, they seem to have the attitude that we have no right to object to ponying up, as the money was never ours to begin with.

To an extent, that is a truth, because everything belongs to its Creator, and we didn’t create this universe. But then, according to many libertarian types, neither did government! 😉

I think that it is pretty obvious that I agree with those “many libertarian types”–for the most part. This, though, is where things get confusing: It was the government that created the dollar bills, but WE created government. Thus, the argument continues.

There IS a way out of the confusion, though, I think. When we go to work, are we ultimately working for money? Or what money buys? I believe that it the latter. Thus, money doesn’t hold value, except insofar as it represents real wealth.

Government doesn’t create wealth, but then, that’s not its job; that is to make it easier for us to create wealth. That includes protecting us, because it’s harder to create wealth while we’re being victimised. And part of that protection is taking some reasonable actions to protect us from “negative externalities” like pollution.

(As you can see, I’m NOT an anarchist! 😉 )

Moreover, I also believe that wealth belong to those the creator assigns ownership rights to–and so on down the line of ownership. Property rights are necessary to wealth creation, and I believe that the Creator assigned ownership rights of our stewardship of earth’s resources! 😉

Do I make sense?

Perhaps more of Patriot blood, jer; after all, the Nephites DID accept King Noah’s tax hikes! 😉

Steven Danderson, you make a lot of sense. And when I have more time I wish to engage you further on this topic. In the meantime let me leave you with this idea.

Government comes from the people, it has no more rights than the people give it. When it becomes its own living entity and begins social engineering (re distributing wealth etc.), it has becomes opposed to the purpose for which is was created, and the Declaration of Independence holds a remedy for that.

Rights come from God. One of the rights we have is to keep the rewards of our labor (otherwise we are slaves), known as wealth. And when the government takes more from us by force than is required to protect the rights of the individual, it is stealing.

-David

Hi David!

I agree. Frederic Bastiat called it, “Legal Plunder.”

May I recommend a couple books on this topic?

The first is an hour read by Pres. Ezra Taft Bensen: “The Constitution, a Heavenly Banner.”

Second: “The Creature from Jekyll Island.” (Griffin) LINK

Third: “Hope and Tragedy” (Quigley) LINK

-David

David:

I think I have ALL of those books!

I KNOW I have President Benson’s book. He’s a political hero of mine! 😉

I think President Benson’s attitude to the Birchers and the “Freepers” (www.freerepublic.com and like web site afficionados) is similar to Milton Friedman’s attitude toward anarchists (and mine toward both): While I’m not willing to go quite that far, we should be moving in that direction! 😉

I was planning to write about this issue but you are faster then me.

Very nice information. Thanks for share.Look forward to reading more from you in the future.

Daily News:

Why NOT write about it? I’m sure you can add to the discussion! 😉

Thanks for the kind words joomla. I look forward to feedback!

I wrote a couple articles about the same subject but you seem to know a bit more about it than I do.

Did you post a few of these things on another blog? That one post looked very familiar. Maybe I saw something about it on the news?

I thought that you would have a bit more feedback posted but anyway, great blog.

Wicked site man. I really like the theme you used. Is it a free one?

I wrote a couple articles about the same subject but you seem to know a bit more about it than I do.

Hi Khalil!

Yes, WordPress is free.

Hi Jamaica!

I’m not sure why the lack of feedback either! Perhaps when it was new, few saw it. Perhaps others look at the use of supply-side economics and think “Political!” when, at the same time, they view Keynesianism or Marxism as “academic”….

You should put a few more ads on your site as you could probably make a lot of money. This is great writing.

Did you design the site on your own or is this a free template? Either way, it looks great. Cheers.

I’ll be adding a link from my site to yours. This is quality stuff. Keep it coming!

Did you post a few of these things on another blog? That one post looked very familiar. Maybe I saw something about it on the news?

I usually do not comment on blog posts but I found this quite interesting, so here goes. Thanks! Regards, P.

amazing stuff thanx 🙂

I came across your site while searching on MSN and have now added you to my rss reader. I Just though i should say “keep up the good work” and pass on congratulations on a job well done and great advice too!

There is obviously a lot to know about this. I think you made some good points in Features also.

I wish getting over a broken heart can be so easy as following a few steps.. but its not